SPRING 2021

#GOALS: Why setting yours early can enhance your financial future

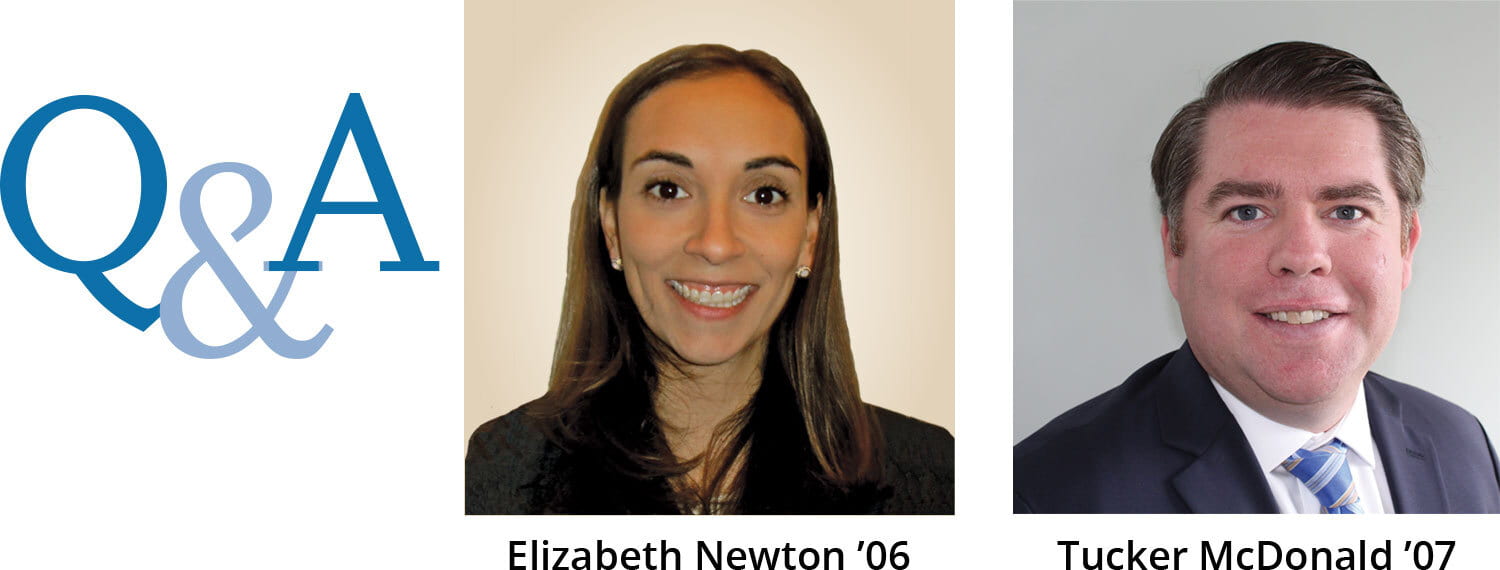

Q. Why is it so crucial for young professionals to start planning and saving early?

T. The short answer is that the longer your time horizon, the more successful your likely outcomes become. Compound growth and higher probabilities of success give you financial peace of mind—let alone greater ability to better absorb risk or unexpected expenses. So I can’t stress enough the need to plan and to regularly revisit and update the plan as life—jobs, salaries, benefits, health, family priorities—are constantly changing.

L. It’s important to have the documents expressing your wishes in place before anything happens to you. It also gets you more comfortable with the process, so that when your estate gets a little more complicated, you’ll be familiar with the documents and know what questions to ask, which you might not have considered when you first started forming your estate plan.

Q. How should readers go about prioritizing their financial planning goals?

T. Start by brainstorming and writing down your goals. Assign time frames to each. Then, determine the resources needed to achieve those goals (not necessarily money) versus the resources at your disposal. Assess that “gap,” and prioritize your goals from there.

Q. Once they’ve established a basic estate plan, does it make sense for a young professional to set up a trust? What are the pros and cons?

L. It depends entirely on each individual’s situation. There are many types of trusts, all with underlying objectives. Common examples of when a trust would be useful to a young professional include:

- If they have minor children, as well as in the unfortunate event that both parents pass away while the children are young—until the children reach a mature age, that money needs to be managed on the children’s behalf.

- If a married couple has a taxable estate and they want to minimize estate taxes due upon death of the surviving spouse.

- If they want to avoid probate upon death.

Trusts can be revocable or irrevocable. The biggest downside of an irrevocable trust is that once it is signed, the terms cannot be changed—even if your wishes do. And the funds held in the irrevocable trust can only be distributed according to the terms of the trust when it was signed.

A revocable trust can be amended, revoked, or terminated during the lifetime of the donor (the person who created the trust), and they still have access to and control over the money in the trust during their lifetime. However, upon the donor’s death, the revocable trust becomes irrevocable.

5 TIPS for selecting a financial or estate planning advisor

Hear more from Tucker and Liz by watching their recent webinar at bc.edu/shawwebinars and download the presentation.

More from this edition

Doing Well by Doing Good

For Roger Keith, the connections formed during his time at the Heights inspired him to pay forward to today’s Eagles all the help and goodwill he received.

Enriching their future —and yours

For so many—myself included—Boston College has been a beacon through these challenging times. It’s as clear as ever that the world needs BC, as the men and women formed at the Heights continue to make a difference in the world in ways big and small.

A Scholarship’s Second Act

A bequest to their son’s memorial scholarship fund will help even more Eagles land at the Heights. Jim and Joan Peck believe that giving to BC through a bequest is a way to both honor their son, Andrew, and allow his memory to live on.