SUMMER 2024

Make an Impact on the Future of BC

When BC parents Kathryne Lyons and Jonathan Teplitz explored the various ways they could support Boston College, a deferred charitable gift annuity (CGA) stood out as the best option for their portfolio—plus it qualified them to join the Parents Leadership Council and Parent Partners. “The CGA is a way for us to show commitment to BC and also get something back,” says Kathryne. “It’s a give and get—and demonstrates our belief in the future of the institution.”

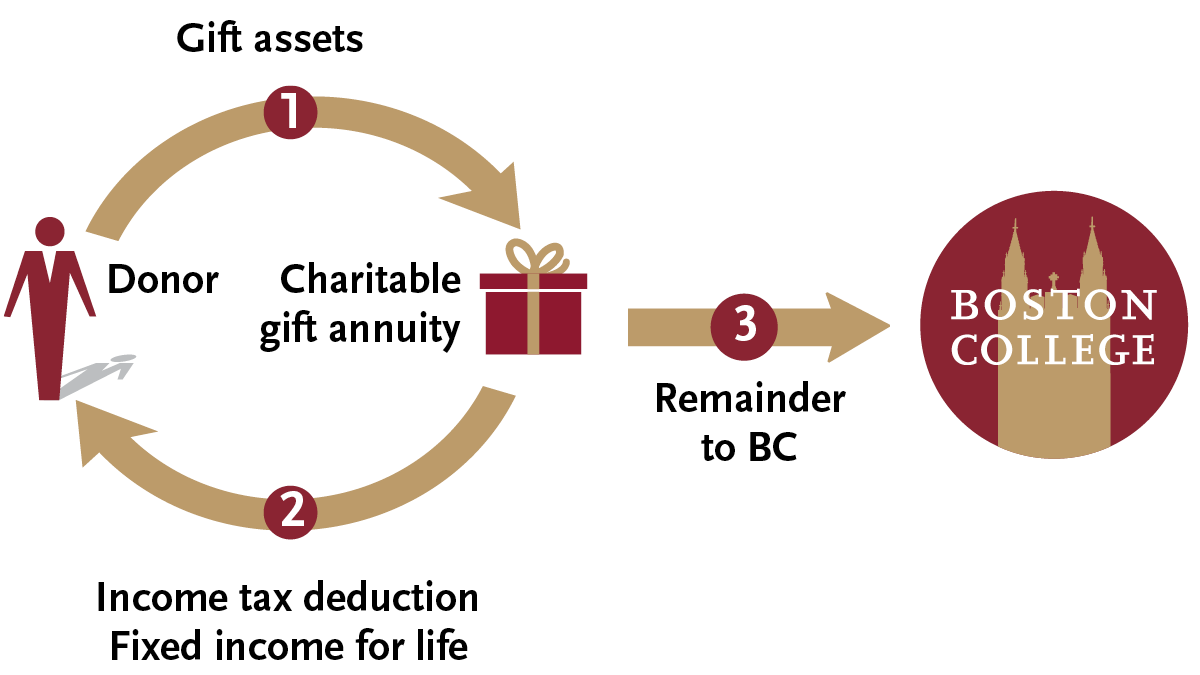

A charitable gift annuity is a simple contract in which you make a gift to Boston College and you—or other beneficiaries you name—receive fixed payments for life.

How It Works

In exchange for a minimum gift amount of $25,000 in cash or securities, you and/or your beneficiary will receive fixed income for life, backed by the assets of the University. At the passing of your named beneficiaries, BC will receive the remainder of the gift.

- Your gift annuity payment amount is based on your and/or your beneficiary’s age.

- You also may be eligible to claim a charitable income tax deduction in the year in which you make your gift.

- Payments can begin immediately or you can choose to defer your income like Kathryne Lyons and Jonathan Teplitz.

- If you are 70 1/2 or older, you can also make a one-time tax-free Qualified Charitable Distribution (QCD) from your IRA in exchange for a CGA.

How It Works

Qualified donors can use their Individual Retirement Account (IRA) to make an outright gift to Boston College and avoid income tax from the IRS on the distribution.

In order for the IRA transfer to qualify:

- You must be 70 ½ years of age or older when the gift is made.

- Charitable distributions cannot exceed $105,000 per IRA holder in a tax year.

- Transfer can be from traditional, rollover, or inherited IRAs, as well as inactive SEP and SIMPLE plans.

- Transfer must be made directly from the IRA administrator to Boston College.

You cannot take a charitable deduction for this type of contribution. The tax benefit you receive is excluding this contribution from your gross income, therefore not having to pay federal income taxes on it.

Under certain circumstances, a donor who is 70 ½ or older can make a one-time tax-free Qualified Charitable Distribution (QCD) from their IRA in exchange for charitable gift annuity (CGA). Click here for details and qualifications.

Try our free online calculator to understand your options. You can also contact the Office of Gift Planning at 877-304-SHAW or at giftplanning@bc.edu to start the process, ask questions, and get personal support.

More from this edition

Opposing Counsel, Unified Hearts

Sylvia and Matthew Kerrigan ’82 established a bequest to endow a professorship in the Morrissey College of Arts and Sciences.

Summer’s Farewell and Fall’s Arrival

Securing the future of BC is on all of our minds as Soaring Higher: the Campaign for Boston College marks one year since its kickoff last September. In this issue, you will read about the many ways you can support the University while maximizing benefits and minimizing liabilities.

From Parents to Partners

A gift to Boston College could provide you with an immediate charitable tax deduction, fixed payments for life, and future support to BC!